Private equity (PE) has become an increasingly influential force in global finance, driving significant changes across industries and economies. As the world experiences rapid shifts in technology, geopolitics, and environmental concerns, the private equity landscape is evolving in response. Understanding how these global trends impact private equity is crucial for investors, portfolio managers, and businesses alike. This article explores key global trends shaping the private equity sector and the implications for future investments.

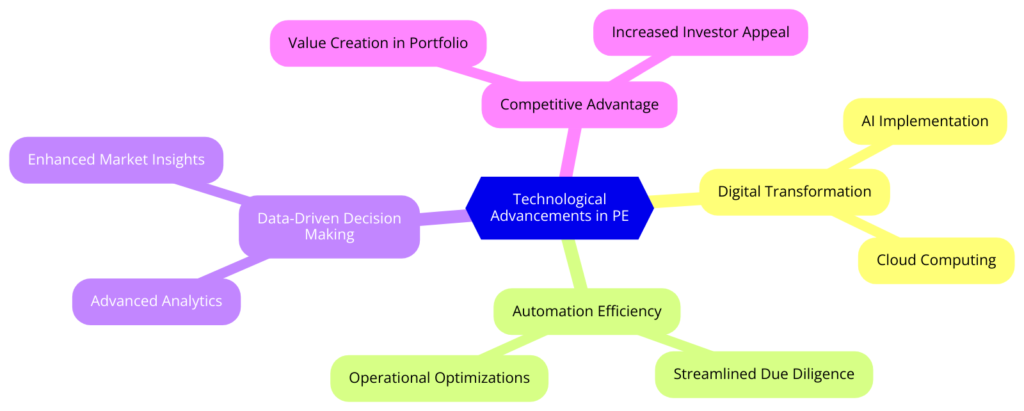

Technological Advancements and Digital Transformation

Technology is a driving force in the evolution of private equity. The rapid pace of digital transformation is reshaping industries and creating new opportunities for private equity firms. As businesses increasingly adopt digital technologies, private equity firms are targeting companies that lead in areas like artificial intelligence, cloud computing, and cybersecurity.

Private equity firms are investing in technology-driven companies and leveraging digital tools to optimize their own operations. From automating due diligence processes to using data analytics for better decision-making, technology is enhancing efficiency and effectiveness in private equity investments. Firms that embrace these technologies are better positioned to identify high-growth opportunities and drive value creation within their portfolios.

Geopolitical Uncertainty and Regulatory Changes

Geopolitical developments and regulatory shifts play a significant role in shaping the private equity landscape. Trade tensions, shifts in global power dynamics, and regulatory changes in key markets can create both challenges and opportunities for private equity firms. For example, increased scrutiny on foreign investments, particularly in sensitive sectors like technology and defense, has prompted private equity firms to be more strategic in their cross-border investments.

In addition, changes in tax policies and regulatory frameworks in different regions can impact the attractiveness of certain markets. Private equity firms must navigate these complexities to minimize risks and capitalize on opportunities. This requires a deep understanding of the geopolitical environment and a proactive approach to regulatory compliance.

The Rise of Environmental, Social, and Governance (ESG) Criteria

Environmental, Social, and Governance (ESG) considerations have become increasingly important in the private equity sector. Investors are demanding greater transparency and accountability in how their capital is deployed, with a growing focus on sustainability and ethical practices. This shift is driving private equity firms to integrate ESG criteria into their investment strategies.

Firms that prioritize ESG are better positioned to attract capital from institutional investors and create long-term value. This trend is particularly evident in sectors such as renewable energy, sustainable agriculture, and social impact ventures. By investing in companies that align with ESG principles, private equity firms can contribute to positive societal outcomes while achieving competitive financial returns.

Demographic Shifts and Emerging Markets

Demographic changes, such as aging populations in developed countries and a growing middle class in emerging markets, are influencing private equity investment strategies. In developed markets, private equity firms are increasingly focused on sectors that cater to the needs of older populations, such as healthcare, retirement services, and pharmaceuticals.

In contrast, the rise of the middle class in emerging markets presents significant growth opportunities for private equity investments in consumer goods, financial services, and infrastructure. These markets offer the potential for high returns, but they also come with challenges such as political instability and regulatory uncertainty. Private equity firms that can effectively navigate these risks are well-positioned to capitalize on the opportunities presented by these demographic shifts.

The Impact of Globalization and Supply Chain Disruptions

Globalization has expanded the reach of private equity, enabling firms to invest in companies across borders and tap into global markets. However, recent events, such as the COVID-19 pandemic and trade wars, have exposed vulnerabilities in global supply chains, leading to a reevaluation of globalization strategies.

Private equity firms are now more focused on building resilient supply chains and investing in companies that can adapt to these disruptions. This has led to increased interest in sectors like logistics, automation, and domestic manufacturing. By investing in companies that prioritize supply chain resilience, private equity firms can mitigate risks and ensure the stability of their portfolio companies.

The Influence of Monetary Policy and Economic Conditions

Monetary policy and economic conditions are fundamental drivers of private equity activity. Low-interest rates and abundant liquidity have historically fueled private equity investments, making it easier for firms to raise capital and finance deals. However, changes in monetary policy, such as interest rate hikes or tightening credit conditions, can impact the availability of financing and the cost of leverage.

In response to these changes, private equity firms may adjust their investment strategies, focusing on sectors with stable cash flows or pursuing value-creation strategies that do not rely heavily on leverage. Understanding the broader economic environment and anticipating shifts in monetary policy are crucial for private equity firms to navigate market cycles and maintain strong performance.

Innovation in Fundraising and Capital Deployment

The private equity industry is also experiencing innovation in fundraising and capital deployment. The rise of alternative investment vehicles, such as special purpose acquisition companies (SPACs) and direct listings, is changing how private equity firms raise capital and exit investments. These innovations offer new ways for firms to access capital markets and provide liquidity to investors.

Additionally, the increasing interest in co-investment opportunities, where institutional investors partner directly with private equity firms on specific deals, is reshaping the fundraising landscape. This trend allows investors to have more control over their investments and align their interests more closely with those of private equity managers.

In Conclusion

Global trends are reshaping the private equity landscape, presenting both challenges and opportunities for investors. Technological advancements, geopolitical shifts, ESG considerations, demographic changes, and innovations in fundraising are all influencing how private equity firms operate and invest. By staying attuned to these trends and adapting their strategies accordingly, private equity firms can continue to thrive in a rapidly changing global environment. For investors, understanding these trends is key to making informed decisions and achieving long-term success in the private equity market.

Thomas J. Powell is the Senior Advisor at Brehon Strategies, a seasoned entrepreneur and a private equity expert. With a career in banking and finance that began in 1988 in Silicon Valley, he boasts over three and a half decades of robust experience in the industry. Powell holds dual citizenship in the European Union and the United States, allowing him to navigate international business environments with ease. A Doctor of Law and Policy student at Northeastern University, he focuses on middle-income workforce housing shortages in rural resort communities. He blends his professional acumen with a strong commitment to community service, having been associated with the Boys and Girls Clubs of America for over 45 years. Follow Thomas J Powell on LinkedIn, Twitter,Crunchbase.