In 2024, the private equity (PE) landscape presents a dynamic and evolving scene, marked by a complexity that challenges even the most seasoned investors. The sector continues to navigate through a myriad of critical factors that influence its daily operations and long-term strategies. From rapid technological advances to fluctuating economic policies, private equity firms must remain agile and informed to thrive.

This year, private equity faces a significant challenge due to the rising interest rates which have cooled off some of the deal-making fervor seen in previous years. These higher costs of capital are reshaping investment strategies, forcing firms to be more judicious in their selections and creative in structuring deals. However, these challenges also open doors to opportunities—especially for firms that can capitalize on distressed assets and those that can innovate to improve liquidity and returns.

This article aims to delve deep into the current private equity environment, offering strategic insights for investors and highlighting the trends that are expected to shape the industry throughout the year. By understanding both the hurdles and the potential windfalls, investors can better navigate this complex market.

Economic and Market Dynamics

Interest Rates and Investment Climate

The private equity sector in 2024 continues to reel under the impact of spiking interest rates that began affecting the global economy in the previous years. These elevated rates have not only made borrowing more expensive but have also introduced a cautious approach to deal-making among PE firms. As capital becomes pricier and the cost of deals goes up, PE firms are pushed to reassess their strategies, focusing more on value creation through operational improvements rather than relying on financial engineering alone.

Global Economic Influences

On a broader scale, global economic conditions such as persistent inflation and market volatility play a crucial role in shaping private equity strategies. Inflation, while moderating, remains high by historical standards, affecting everything from asset valuations to the general cost of operations. This economic pressure tests the resilience of private equity firms, demanding innovations in how they manage funds, approach deals, and strategize exits. Moreover, as public equity markets start to recover, the private markets must adapt to the shifting valuation paradigms and investor expectations.

Key Trends in Private Equity

Strategic Shifts and Value Creation

In 2024, private equity (PE) firms are increasingly moving away from traditional investment strategies that relied heavily on financial leverage to drive returns. Instead, there’s a marked shift towards more operationally focused value creation. This strategic pivot involves enhancing the operational efficiencies of portfolio companies and driving growth organically or through strategic acquisitions. This approach is particularly crucial in a landscape characterized by high purchase price multiples and intense competition for quality assets. Firms are now required to dig deeper into their operational capabilities to unlock value and deliver substantial returns to their investors.

Technological Integration

Technological integration continues to reshape the private equity landscape, with artificial intelligence (AI) leading the charge. In 2024, PE firms are increasingly deploying AI and machine learning algorithms not only to streamline back-office functions but also to enhance due diligence and improve the overall decision-making process. These technologies enable firms to analyze vast amounts of data rapidly, identify patterns that would be imperceptible to human analysts, and make more informed investment decisions. The integration of AI is expected to drive significant efficiencies and potentially transform every facet of private equity operations.

Sector-Specific Impacts

Industries on the Rise

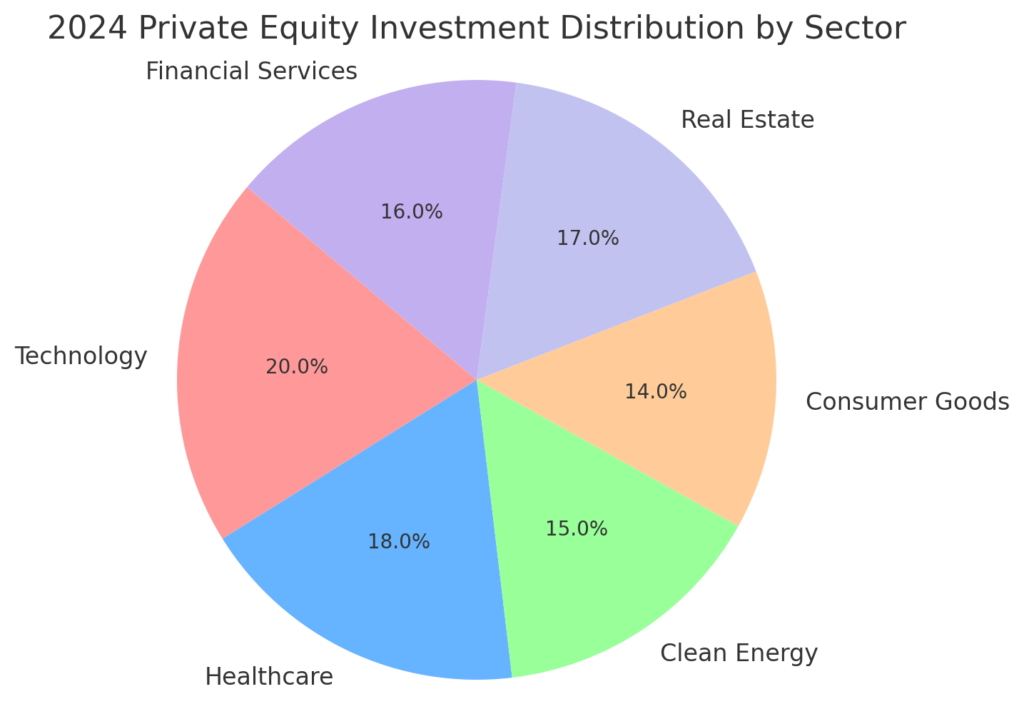

As private equity firms adapt to the changing economic and technological environment, certain sectors are emerging as particularly attractive for investment. Clean energy and technology sectors are especially notable, drawing considerable attention from investors looking to capitalize on the global shift towards sustainability and digital transformation. These sectors offer substantial growth potential and are aligned with broader environmental and technological trends reshaping industries worldwide.

Challenges in Traditional Sectors

Traditional sectors such as real estate and healthcare continue to face significant challenges. In real estate, elevated interest rates have cooled market activity, leading to valuation pressures and longer hold periods for assets. In healthcare, regulatory complexities and shifting consumer preferences are forcing PE firms to rethink their investment strategies. Private equity is responding by leveraging technology and industry expertise to improve operational efficiencies and adapt to these evolving market conditions.

Dealing with Financial Pressures

Capital Management

In the current high-interest rate environment, effective capital management has become crucial for private equity firms. Managing liquidity, optimizing capital structures, and controlling costs are top priorities. Firms are becoming more strategic in their use of debt, often opting for more conservative leverage levels to mitigate financial risk. Additionally, PE firms are focusing on generating robust cash flows from operations as a buffer against potential market downturns.

Exit Strategies

The challenging selling environment of 2024 has prompted PE firms to innovate their exit strategies. With traditional exit routes such as initial public offerings (IPOs) becoming less viable due to market volatility, private equity is exploring alternative pathways like secondary sales or direct listings. These approaches require a more nuanced understanding of market dynamics and a readiness to adapt to the liquidity needs of the firm and its investors.

Regulatory and Geopolitical Considerations

Compliance and Regulatory Challenges

The regulatory landscape for private equity in 2024 continues to evolve, presenting both challenges and strategic considerations for firms globally. New compliance requirements are being introduced as governments seek greater transparency and accountability in financial transactions. Additionally, geopolitical risks, such as trade tensions and fluctuating policies, necessitate agile strategies to mitigate potential impacts on investment flows and returns. Private equity firms must navigate these complexities by enhancing their compliance infrastructures and staying abreast of regulatory changes that could affect their operations and investment strategies.

Impact of International Markets

International markets, especially emerging economies, are playing an increasingly significant role in shaping private equity investment strategies. As these markets grow, they offer new opportunities for diversification and returns that are often higher than those available in more developed economies. However, investing in these regions requires a nuanced understanding of local market dynamics, regulatory environments, and cultural factors that can influence business practices and consumer behavior. Success in these markets demands not only capital but also local partnerships and a deep understanding of regional intricacies.

Future Outlook

Predictions for the Near Future

Looking ahead, the private equity sector may see a gradual market recovery as the global economic climate stabilizes. Sectors such as technology, healthcare, and green energy are poised for significant growth, driven by ongoing innovation and increasing societal and governmental support. Moreover, the market is likely to witness a resurgence in deal activity as investors become more accustomed to operating within the new economic parameters set by higher interest rates and adjusted valuation expectations.

Strategies for Investors

For investors navigating the current complexities of the private equity market, it’s essential to focus on long-term value creation through operational improvements and strategic market positioning. Diversifying investments across sectors and geographies can mitigate risks associated with market volatility. Additionally, staying informed about regulatory changes and leveraging technological advancements can enhance due diligence processes and operational efficiencies, positioning firms to capitalize on emerging opportunities effectively.

In Conclusion

As we navigate the complex world of private equity in 2024, it’s clear that adaptability and strategic foresight are more crucial than ever. From grappling with regulatory changes to leveraging new technologies and tackling geopolitical challenges, private equity firms must stay agile to thrive. The landscape is undoubtedly challenging, but with these hurdles also come significant opportunities for those prepared to innovate and adapt. Looking forward, the ability to anticipate changes and react proactively will distinguish the most successful firms in this dynamic environment. Embracing these challenges as opportunities for growth and learning will be key to navigating the future successfully.

Thomas J. Powell is the Senior Advisor at Brehon Strategies, a seasoned entrepreneur and a private equity expert. With a career in banking and finance that began in 1988 in Silicon Valley, he boasts over three and a half decades of robust experience in the industry. Powell holds dual citizenship in the European Union and the United States, allowing him to navigate international business environments with ease. A Doctor of Law and Policy student at Northeastern University, he focuses on middle-income workforce housing shortages in rural resort communities. He blends his professional acumen with a strong commitment to community service, having been associated with the Boys and Girls Clubs of America for over 45 years. Follow Thomas J Powell on LinkedIn, Twitter,Crunchbase.