Private equity has become a powerful force in the financial world, providing companies with the capital they need to grow and innovate. This type of investment involves private equity firms investing in companies, typically taking a significant ownership stake and working closely with management to improve performance and increase value. For businesses seeking long-term growth, private equity can offer numerous advantages, from access to capital and strategic expertise to operational improvements and market expansion. In this article, we will explore the benefits of private equity for long-term growth, examining how it works, its advantages, and its impact on companies and investors. By the end of this article, you’ll have a comprehensive understanding of how private equity can drive sustainable growth and success.

Understanding Private Equity

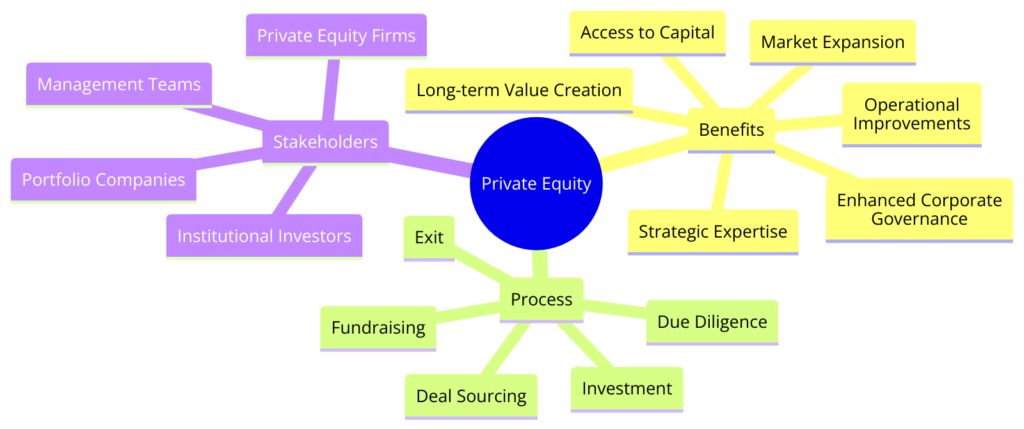

Private equity refers to investment funds that acquire equity ownership in private companies. These investments are usually made by private equity firms, which raise capital from institutional investors, such as pension funds, endowments, and high-net-worth individuals. The primary goal of private equity is to generate high returns on investment by enhancing the value of the companies in which they invest.

Private equity investments typically involve a few stages: fundraising, deal sourcing, due diligence, investment, and exit. The process starts with raising capital from investors, followed by identifying and evaluating potential investment opportunities. Once a suitable target is found, the private equity firm conducts thorough due diligence to assess the company’s financial health, management team, market position, and growth potential. After acquiring a stake in the company, the firm works closely with management to implement strategies for growth and value creation. Finally, the firm exits the investment through a sale or initial public offering (IPO), realizing returns for its investors.

Unlocking Long-term Growth with Private Equity

Access to Capital

One of the most significant benefits of private equity is access to substantial capital. For many companies, especially those in the growth stage or undergoing significant transformation, securing adequate funding can be challenging. Traditional financing options like bank loans may be limited or come with restrictive covenants. Private equity provides a reliable source of capital that can be used for various purposes, such as expanding operations, developing new products, acquiring other businesses, or entering new markets.

This access to capital is particularly crucial for businesses that require significant investment to achieve their growth objectives. Private equity firms often have large pools of capital at their disposal, allowing them to provide the necessary funding without the constraints associated with traditional financing. This financial support enables companies to pursue ambitious growth strategies and take advantage of new opportunities.

Strategic Expertise and Guidance

Beyond capital, private equity firms bring valuable strategic expertise and guidance to the companies they invest in. These firms typically have experienced professionals with deep industry knowledge and a track record of successfully growing businesses. By partnering with private equity investors, companies gain access to this expertise, which can be instrumental in driving growth and improving performance.

Private equity firms work closely with management teams to develop and execute strategic plans. This can include identifying new market opportunities, optimizing operations, improving financial management, and enhancing corporate governance. The strategic guidance provided by private equity firms can help companies navigate complex business challenges, make informed decisions, and achieve their long-term goals.

Operational Improvements

Operational improvements are a core focus of private equity investments. Private equity firms often take an active role in identifying inefficiencies and implementing best practices to enhance the operational performance of their portfolio companies. This can involve streamlining processes, reducing costs, improving supply chain management, and leveraging technology to drive productivity.

These operational improvements can have a significant impact on a company’s bottom line, leading to increased profitability and cash flow. By focusing on operational excellence, private equity firms help companies build a strong foundation for sustainable growth. Additionally, the emphasis on efficiency and effectiveness can create a competitive advantage, allowing companies to better serve their customers and outperform their competitors.

Market Expansion and Growth

Private equity can also facilitate market expansion and growth. With access to capital and strategic guidance, companies can explore new markets, develop innovative products, and expand their customer base. Private equity firms often have extensive networks and industry connections, which can be leveraged to support market entry and growth initiatives.

Entering new markets can be a complex and risky endeavor, but private equity firms can help mitigate these risks by providing market insights, strategic partnerships, and financial backing. Whether it’s expanding geographically or launching new product lines, private equity can play a crucial role in helping companies achieve their growth ambitions.

Enhanced Corporate Governance

Improving corporate governance is another key benefit of private equity. Private equity firms typically implement robust governance structures and practices to ensure accountability, transparency, and effective decision-making. This can include establishing a strong board of directors, implementing rigorous financial controls, and setting clear performance metrics.

Enhanced corporate governance can lead to better management oversight, more strategic decision-making, and improved stakeholder confidence. For companies looking to scale and attract further investment, strong governance practices are essential. Private equity firms bring the expertise and frameworks needed to elevate corporate governance standards, contributing to long-term success and sustainability.

Long-term Value Creation

The ultimate goal of private equity is long-term value creation. Unlike some short-term investors, private equity firms typically take a longer investment horizon, often holding investments for several years. This long-term perspective allows them to focus on sustainable growth strategies and value creation rather than short-term gains.

Private equity firms align their interests with those of the companies they invest in, working collaboratively to achieve mutual success. By fostering a culture of continuous improvement, innovation, and strategic growth, private equity firms help companies unlock their full potential and create lasting value for stakeholders.

In Conclusion

Private equity offers numerous benefits for companies seeking long-term growth, from access to substantial capital and strategic expertise to operational improvements and market expansion. By partnering with private equity firms, companies can navigate complex business challenges, optimize their operations, and achieve their growth objectives. Enhanced corporate governance and a focus on long-term value creation further contribute to the success and sustainability of private equity-backed companies. As businesses continue to evolve in an increasingly competitive and dynamic market, private equity remains a powerful tool for driving growth and achieving lasting success.

Thomas J. Powell is the Senior Advisor at Brehon Strategies, a seasoned entrepreneur and a private equity expert. With a career in banking and finance that began in 1988 in Silicon Valley, he boasts over three and a half decades of robust experience in the industry. Powell holds dual citizenship in the European Union and the United States, allowing him to navigate international business environments with ease. A Doctor of Law and Policy student at Northeastern University, he focuses on middle-income workforce housing shortages in rural resort communities. He blends his professional acumen with a strong commitment to community service, having been associated with the Boys and Girls Clubs of America for over 45 years. Follow Thomas J Powell on LinkedIn, Twitter,Crunchbase.