The landscape of private securities investment is evolving rapidly, driven by advancements in technology, changes in market dynamics, and shifting investor preferences. This evolution is reshaping how investments are made, managed, and evaluated. Understanding these changes is crucial for investors, fund managers, and financial professionals to navigate the complexities of this sector effectively. This article explores the key factors reshaping private securities investment, including technological innovations, market consolidation trends, the rise of ESG (Environmental, Social, and Governance) investing, the impact of generative AI, evolving investor preferences, and the importance of geographic diversification. By examining these elements in detail, we aim to provide a comprehensive overview that will help stakeholders make informed decisions and capitalize on emerging opportunities.

Technological Advancements

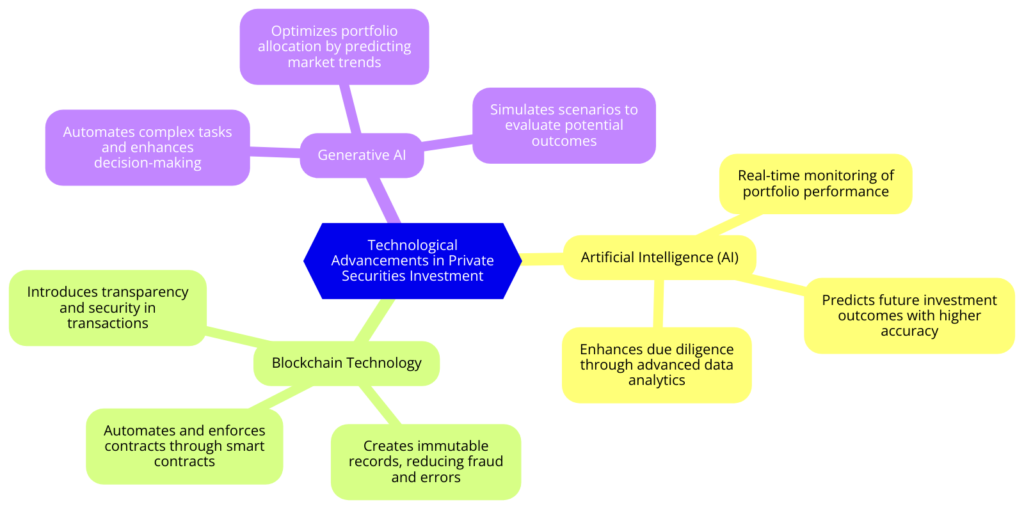

Technological advancements are fundamentally transforming private securities investment. Innovations such as artificial intelligence (AI) and blockchain technology are at the forefront of this transformation, offering unprecedented capabilities for data analysis, operational efficiency, and security. AI enhances due diligence processes by providing deeper insights through advanced data analytics, allowing investors to evaluate vast amounts of data quickly and identify patterns and trends that were previously undetectable. For example, AI can analyze historical performance data, market conditions, and financial metrics to predict future investment outcomes with higher accuracy. Additionally, AI-driven tools facilitate real-time monitoring of portfolio performance, enabling proactive adjustments to investment strategies. Blockchain technology introduces new levels of transparency and security in private securities transactions by creating immutable records, reducing the risk of fraud and errors. Smart contracts, a feature of blockchain, automate and enforce contractual agreements, streamlining processes and reducing costs, making private securities investment more efficient and accessible. As these technologies continue to mature, they are expected to play an even more significant role in shaping the future of private securities investment.

Market Consolidation

The private equity sector is experiencing a wave of consolidation, driven by the need to achieve economies of scale, diversify investment portfolios, and respond to competitive pressures. Larger firms are increasingly acquiring smaller ones to expand their asset base and offer a broader range of services. This trend is particularly pronounced among publicly traded alternative asset managers, who leverage their financial strength to dominate the mergers and acquisitions landscape. For instance, major firms pursue strategic acquisitions to diversify their capabilities and enter new markets. This strategy allows them to tap into new asset classes and geographies, enhancing their appeal to a diverse investor base. The pursuit of diversified investment strategies helps firms navigate market fluctuations and capitalize on emerging opportunities. For example, Sweden’s EQT has made several strategic acquisitions, including the notable $7.5 billion purchase of Baring Private Equity Asia, showcasing the expansion into the Asia-Pacific region. Such consolidation efforts are expected to continue as firms seek to strengthen their market positions and offer comprehensive investment solutions.

Rise of ESG Investing

The rise of ESG (Environmental, Social, and Governance) investing is a key factor transforming private securities investment. Investors are increasingly prioritizing sustainability and ethical considerations in their investment decisions, driven by both regulatory pressures and a growing recognition of the long-term value associated with sustainable practices. ESG investing involves evaluating companies based on their environmental impact, social responsibility, and governance practices. This holistic approach aims to identify companies that are not only financially sound but also contribute positively to society and the environment. Private equity firms are incorporating ESG criteria into their investment processes to attract capital and meet regulatory expectations. This involves conducting thorough ESG assessments during due diligence, monitoring ESG performance throughout the investment lifecycle, and engaging with portfolio companies to improve their ESG practices. The focus on ESG is reshaping investment strategies, as firms seek to align their portfolios with sustainable and ethical values. This trend is expected to grow as investors increasingly demand transparency and accountability in how their investments impact the world.

The Impact of Generative AI

Generative AI is causing significant disruption across industries, and its impact on private securities investment is profound. This technology automates complex tasks, enhances decision-making processes, and unlocks new possibilities for value creation. For private equity investors, understanding the potential of generative AI is crucial for optimizing portfolio management and identifying growth opportunities. Generative AI can analyze vast amounts of data, generate predictive models, and provide actionable insights that drive investment decisions. For example, generative AI can optimize portfolio allocation by predicting market trends and identifying the best investment opportunities based on historical data and current market conditions. It can also enhance operational efficiency by automating routine tasks such as data entry, compliance reporting, and risk management. Additionally, generative AI can support strategic decision-making by simulating different scenarios and evaluating their potential outcomes. By leveraging generative AI, private equity firms can gain a competitive edge, improve their decision-making processes, and achieve better investment outcomes.

Investor Preferences and Diversification

Investor preferences are evolving, with a growing emphasis on diversified and resilient investment strategies. Investors are increasingly seeking comprehensive investment solutions that cover various asset classes and geographies. This shift is prompting private equity firms to expand their capabilities and offer a broader range of services, including wealth management and advisory. Diversification enhances the ability to navigate market fluctuations and capitalize on emerging opportunities, making firms more attractive to a diverse investor base. For example, private equity firms are expanding into new asset classes such as real estate, infrastructure, and private credit to offer more diversified investment options. They are also entering new geographic markets to tap into global economic growth and reduce exposure to regional economic downturns. This strategy allows firms to provide comprehensive investment solutions that meet the evolving needs of their clients. By diversifying their portfolios and expanding their service offerings, private equity firms can attract more investors and enhance their market positions.

Geographic Diversification

Geographic diversification is becoming increasingly important in private securities investment. Investors are looking beyond traditional markets to minimize specific market risks and tap into global economic growth. By diversifying geographically, investors can reduce their exposure to regional economic downturns and inflation risks. This strategy is particularly relevant in the context of global economic uncertainties, where spreading investments across different regions can enhance stability and potential returns. For instance, investing in emerging markets can provide access to high-growth opportunities that are not available in more developed markets. Geographic diversification also allows investors to benefit from different economic cycles and regulatory environments, enhancing their ability to navigate market fluctuations. Private equity firms are expanding their presence in international markets to offer clients diversified investment opportunities and capture global growth potential. This trend is expected to continue as investors seek to enhance their portfolios’ resilience and capitalize on global economic opportunities.

In conclusion, the landscape of private securities investment is changing rapidly, influenced by technological advancements, market consolidation trends, the rise of ESG investing, the impact of generative AI, evolving investor preferences, and the importance of geographic diversification. These factors are reshaping how investments are made, managed, and evaluated. For investors and firms, staying ahead in this dynamic environment requires a deep understanding of these trends and the ability to adapt strategies accordingly. By leveraging new technologies, diversifying investment portfolios, and focusing on sustainable and ethical practices, stakeholders can navigate the complexities of the current investment landscape and capitalize on emerging opportunities. Embracing these changes will enable investors and firms to achieve better investment outcomes, enhance their market positions, and contribute positively to the broader economy.

Thomas J. Powell is the Senior Advisor at Brehon Strategies, a seasoned entrepreneur and a private equity expert. With a career in banking and finance that began in 1988 in Silicon Valley, he boasts over three and a half decades of robust experience in the industry. Powell holds dual citizenship in the European Union and the United States, allowing him to navigate international business environments with ease. A Doctor of Law and Policy student at Northeastern University, he focuses on middle-income workforce housing shortages in rural resort communities. He blends his professional acumen with a strong commitment to community service, having been associated with the Boys and Girls Clubs of America for over 45 years. Follow Thomas J Powell on LinkedIn, Twitter,Crunchbase.