Asset protection involves strategic planning to safeguard your wealth from potential creditors, lawsuits, and other financial threats. With rising economic uncertainties and increasing legal risks, having a well-thought-out asset protection plan is more important than ever. This article highlights key asset protection techniques, discussing their importance and providing actionable steps for implementation. By understanding and utilizing these strategies, you can protect your assets and ensure long-term financial security.

Utilizing Limited Liability Entities

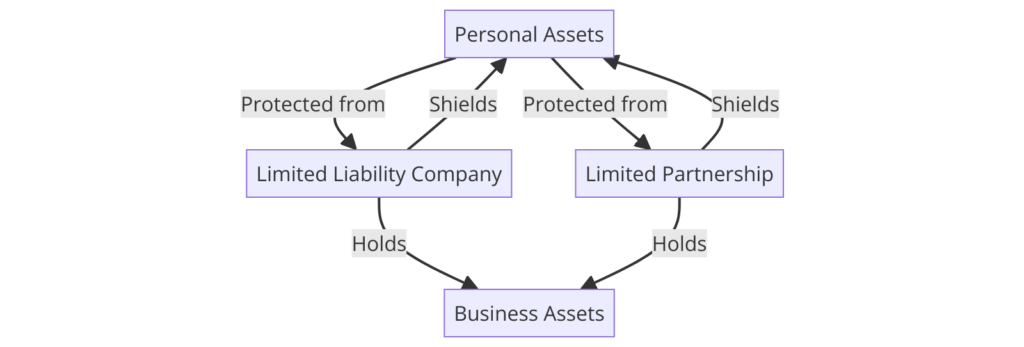

Limited liability entities, such as Limited Liability Companies (LLCs) and Limited Partnerships (LPs), offer a robust way to protect your assets. By structuring your holdings within these entities, you separate your personal assets from business liabilities. This legal separation means that if your business faces a lawsuit or financial trouble, your personal assets remain protected. For example, an LLC owner facing business litigation would not risk losing personal assets like their home or savings, as these are not part of the business entity’s liabilities. Additionally, forming multiple LLCs to hold different properties or assets can further compartmentalize risk, ensuring that issues with one asset do not affect the others. This strategy is particularly beneficial for real estate investors who own multiple properties.

Leveraging Insurance Policies

Insurance is a foundational component of any asset protection plan. Policies such as property insurance, liability insurance, life insurance, and umbrella insurance offer coverage for various risks. Umbrella insurance, in particular, provides an additional layer of protection by covering claims that exceed the limits of your standard policies. This can be crucial in protecting personal assets from large claims or lawsuits. For instance, if a homeowner’s liability insurance is capped at $500,000 and they face a $1 million lawsuit, an umbrella policy would cover the remaining $500,000, safeguarding their personal wealth. Furthermore, specialized insurance products, such as errors and omissions insurance for professionals and directors and officers insurance for business leaders, can protect against specific risks associated with their roles.

Establishing Trusts

Trusts are powerful tools for asset protection and estate planning. Irrevocable trusts, in particular, transfer asset ownership from the individual to the trust, placing them beyond the reach of creditors. This not only protects the assets but also provides benefits such as probate avoidance and estate tax reduction. For example, placing assets into an irrevocable trust ensures that they are managed according to your wishes and protected from claims. Domestic Asset Protection Trusts (DAPTs), available in certain U.S. states, offer additional protections by allowing grantors to be beneficiaries while keeping assets shielded from creditors. These trusts can be particularly beneficial for high-net-worth individuals looking to protect significant assets while maintaining some level of control.

Strategic Gifting

Gifting assets to family members or charitable organizations can be an effective asset protection strategy. By transferring ownership of assets during your lifetime, you reduce the value of your estate and protect these assets from potential creditors. However, it is important to balance gifting with your own financial needs and to be aware of potential legal implications, such as fraudulent transfer claims. Strategic gifting, when done correctly, can minimize estate taxes and provide for loved ones without exposing your assets to risk. For instance, utilizing annual gift tax exclusions allows you to gift up to $15,000 per recipient each year without incurring gift tax, thereby reducing the size of your taxable estate.

Asset Segregation

Asset segregation involves dividing your assets into different legal entities or accounts to limit exposure to risks. This technique can include holding real estate in separate LLCs, using different bank accounts for personal and business finances, and employing family limited partnerships (FLPs) to manage family assets. By segregating assets, you create barriers that make it difficult for creditors to access all of your wealth. For instance, a business owner might place their commercial properties in separate LLCs, so if one property faces litigation, the others remain unaffected. This approach ensures that the impact of any financial threat is contained and does not jeopardize your entire asset base.

Retirement Accounts

Retirement accounts, such as 401(k)s and IRAs, offer significant asset protection benefits. These accounts are often shielded from creditors under federal and state laws, making them a safe place to accumulate wealth for the future. Contributions to these accounts can also provide tax advantages, further enhancing their value as an asset protection tool. For example, funds in a 401(k) plan are typically protected from creditors even if the account holder files for bankruptcy, ensuring that retirement savings are preserved. Maximizing contributions to these accounts and understanding the specific protections they offer in your jurisdiction is a prudent strategy.

Offshore Trusts and Entities

For individuals with substantial assets or those exposed to high litigation risk, offshore trusts and entities can provide an additional layer of protection. These structures, established in jurisdictions with favorable asset protection laws, shield assets from domestic creditors and legal claims. However, offshore asset protection requires careful planning and compliance with both local and international laws. For instance, establishing an offshore trust in a jurisdiction like the Cook Islands can protect assets from U.S. court judgments, provided that the trust is set up and managed correctly. It is essential to work with experienced legal and financial advisors to navigate the complexities of offshore asset protection. These advisors can help ensure compliance with tax laws and reporting requirements, avoiding legal complications.

In Conclusion

Asset protection is a critical aspect of financial planning, especially in an increasingly litigious society. By employing strategies such as utilizing limited liability entities, leveraging insurance policies, establishing trusts, and practicing asset segregation, you can safeguard your wealth against potential risks. Proactive planning and professional guidance are essential to ensure that your asset protection measures are effective and compliant with legal standards. Implementing these techniques will provide peace of mind and secure your financial legacy for future generations. As the financial landscape evolves, staying informed and adaptable will help you maintain robust asset protection in 2024 and beyond.

Thomas J. Powell is the Senior Advisor at Brehon Strategies, a seasoned entrepreneur and a private equity expert. With a career in banking and finance that began in 1988 in Silicon Valley, he boasts over three and a half decades of robust experience in the industry. Powell holds dual citizenship in the European Union and the United States, allowing him to navigate international business environments with ease. A Doctor of Law and Policy student at Northeastern University, he focuses on middle-income workforce housing shortages in rural resort communities. He blends his professional acumen with a strong commitment to community service, having been associated with the Boys and Girls Clubs of America for over 45 years. Follow Thomas J Powell on LinkedIn, Twitter,Crunchbase.